Learning Center

Secured vs. Unsecured Debt: A Ball and Chain Approach

When navigating the choppy waters of bankruptcy, understanding the types of debt tied to your financial ship is crucial. In the realm of debt, there are two primary classifications: secured and unsecured. Imagine secured debt as a ball and chain tethered to your leg, while unsecured debt is like carrying a lightweight backpack. Both slow you down, but one is significantly more burdensome and harder to shake off.

Retirement Accounts and Bankruptcy in Oklahoma: Navigating Your Financial Future

Filing for bankruptcy is a significant step in reclaiming your financial stability. It's a process filled with complexities, particularly when it comes to understanding what assets you can keep. In Oklahoma, as in many states, certain exemptions exist to protect some of your hard-earned assets from being seized by creditors. Among the most crucial of these are your retirement accounts. Let's dive into how these accounts are treated in bankruptcy under Oklahoma exemptions and discuss the potential risks of withdrawing from these accounts before filing.

Post-Bankruptcy Foreclosure: Why your lender might foreclose after Chapter 7

When an Oklahoma debtor decides to surrender their home in a Chapter 7 bankruptcy, it often marks the end of a stressful period of financial turmoil. However, the journey towards financial recovery may encounter another legal hurdle: a subsequent in rem foreclosure lawsuit by the mortgage company. Understanding this process is crucial for debtors who have surrendered their homes, as it can impact their path to financial stability.

Understanding Adversary Proceedings in Bankruptcy: A Closer Look at Claims Under Sections 523 and 727

In the realm of bankruptcy, the process is not always as straightforward as filing a petition and receiving a discharge of debts. There's a unique, lawsuit-like component known as an adversary proceeding that can arise, adding complexity to a debtor's bankruptcy case. This article demystifies adversary proceedings, focusing on common claims brought by creditors under sections 523 and 727 of the Bankruptcy Code, and aims to equip you with a foundational understanding of what to expect if you face such proceedings.

Navigating Financial Success After Bankruptcy: A Strategic Guide

Emerging from bankruptcy can feel like being given a second chance—a fresh start at managing your finances without the overwhelming burden of insurmountable debt. However, succeeding financially after bankruptcy requires careful planning, strategic actions, and a commitment to changing previous financial behaviors. This guide outlines practical steps to help you rebuild your financial health and secure a prosperous future after bankruptcy.

Protecting My Car’s Equity in Chapter 7

Filing for Chapter 7 bankruptcy in Oklahoma can be a pathway to relief for those drowning in debt, but it comes with its complexities, especially when it involves assets such as motor vehicles. Understanding how motor vehicles can be claimed exempt is crucial for debtors looking to protect their means of transportation while wiping out unsecured debts. This article delves into the intricacies of Oklahoma bankruptcy exemptions for motor vehicles and explores some common issues that might arise with these exemptions.

The Means Test and Median Income

When considering bankruptcy as a path to financial relief, one critical step in the process is determining your eligibility, particularly for Chapter 7 bankruptcy. A central component of this determination is the "means test," which assesses your financial situation against the median income for your state to evaluate whether you qualify for Chapter 7 or if you must consider Chapter 13 bankruptcy instead.

Tax Refunds and Chapter 7 Trustees

Tax refunds are a lifeline to many Americans. When navigating through the complexities of a Chapter 7 bankruptcy, it's crucial to understand the role of the Chapter 7 trustee in this context and how it affects your tax refunds.

When Can My Attorney Make the Calls Stop?

Experiencing constant calls and collection efforts from creditors can be overwhelmingly stressful, especially when you're already grappling with financial difficulties. One of the most powerful tools at your disposal in such times is the intervention of a bankruptcy lawyer. Understanding when and how a bankruptcy lawyer can legally compel creditors to halt their collection attempts is crucial for anyone considering bankruptcy as a solution to their financial woes.

Can I Pay My Bankruptcy Attorney with a Credit Card?

In the world of bankruptcy, one question that often arises is whether a debtor can pay their bankruptcy attorney's fees using a credit card. This question touches on both practical and legal considerations. While the answer is almost certainly “NO,” there are situations when it might be appropriate.

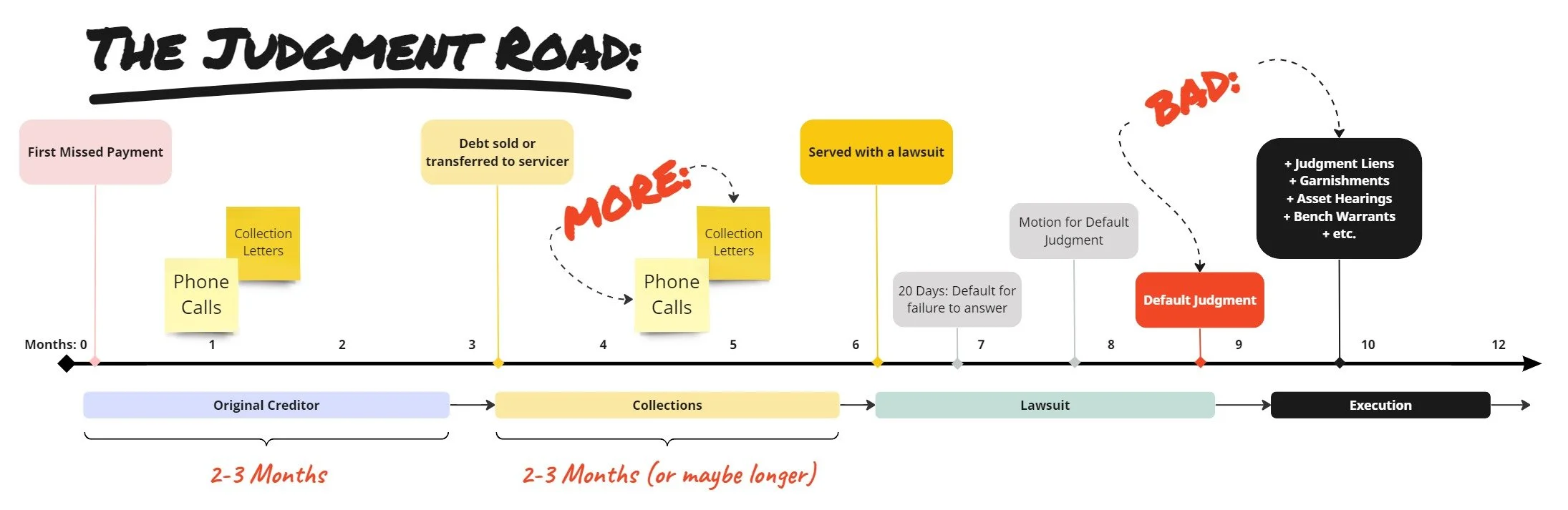

Judgment Road

Lets all agree…being in debt collection is not fun. With many Americans living paycheck to paycheck, the threat of debt collection is a tangible fear — or reality. But what really happens in debt collection? This short article explains what happens in collections and gives you an expected timeline for collection actions.

Whole Life vs. Term Life Insurance: Understanding the Differences and Bankruptcy Implications

Navigating the complex world of life insurance can be daunting, especially when considering the financial safety nets for your loved ones. Two primary types of life insurance—whole life and term life—offer different benefits and serve distinct purposes. Understanding these differences is crucial, not just for financial planning but also for grasping their implications in scenarios like filing for Chapter 7 bankruptcy.

Overdrafts in Bankruptcy: A Fresh Start May Mean a New Bank

When financial turbulence hits, overdraft “protection” can feel like the only lifeline available. However, these temporary fixes can quickly become part of a larger debt problem. Fortunately, an individual can discharge overdrafts on bank accounts in bankruptcy.

Can I pay off a credit card to keep it after bankruptcy?

A common question among individuals considering Chapter 7 bankruptcy is whether they can pay off a specific credit card to retain it post-bankruptcy. The answer, while straightforward, requires understanding the nature of Chapter 7 bankruptcy.

Chapter 7 Bankruptcy and Credit Scores

It may seem counterintuitive, but many debtors actually experience an increase in their credit scores shortly after filing for Chapter 7 bankruptcy. In our experience, most debtor’s will see the credit score trend either up or down to somewhere in the mid-600’s. This surprising phenomenon can be understood by delving into how credit scores are calculated and the specific effects of a Chapter 7 filing.

Will the Trustee take my dog?

Filing for Chapter 7 bankruptcy can be a life-changing decision, not only financially but also emotionally, especially when it comes to the possibility of losing beloved pets. Understandably, this concern weighs heavily on pet owners considering bankruptcy.

Can I Discharge Student Loans?

For many struggling with student loan debt, the possibility of discharging these obligations through bankruptcy offers a glimmer of hope. Section 523(a)(8) of the Bankruptcy Code is the pivotal statute when it comes to student loan discharge. This provision generally excepts educational loans from discharge unless repaying them would impose an “undue hardship” on the debtor and their dependents. The complexity arises in the interpretation of “undue hardship” and the types of loans covered.

Discharging Medical Debt in Bankruptcy

Medical debt can be an overwhelming and unexpected burden. For many, it's a major financial crisis that can lead to the consideration of bankruptcy as a viable solution. In this post, we'll explore how bankruptcy can offer a respite from crippling medical bills.

Bankruptcy or Divorce: Which comes first?

Navigating through bankruptcy and divorce simultaneously can be like trying to find your way through a maze without a map. This blog post aims to shed light on the question many face in this situation: should you file for bankruptcy or divorce first?

Stopping Foreclosure: Chapter 13 Bankruptcy

If you're facing the daunting prospect of foreclosure, you know the stress and uncertainty it brings. It's not just a house; it's your home, filled with memories and dreams. But here's some hopeful news: Filing for Chapter 13 bankruptcy could be the lifeline you need.